income tax rates 2022 australia

Further under the Governments initiative the LITO will be recovered at a lower rate of 5 cents per dollar for taxable incomes between. The following are the seven tax brackets for the 2021 tax year.

What Are The Current Marginal Tax Rates Canstar

Income Tax Rates and Thresholds Annual Tax Rate Taxable Income Threshold.

. Reflected in the above table are tax rate changes from the 2018 Budget for the 2 years from 1. The individual income tax rate in Australia is progressive and ranges from 0 to 45 depending on your income for residents while it ranges from 325 to 45 for non-residents. You can find our most popular tax rates and codes listed here or refine your search options below.

Tax Rates 2021-2022 Year Residents Tax Scale For Year Ended 30 June 2022 Taxable IncomeTax. 10 12 22 24 32 35 and 37 are the general income tax brackets. Australia Personal Income Tax Rate was 45 in 2022.

By Willie Clark On April 28 2022. A subsequent Budget 2019 measure further expanded the 19 income ceiling to 45000 from 1 July 2022. Below 100 to 0 of the portion of your taxable income that.

Tax on this income. Income tax rate and will provide a minimum net tax benefit of 85 with a premium tier of 165 for an RD spend with an intensity exceeding 2. 325c for every dollar between - 0.

The tax bracket you are assigned. 19c for each 1 over 18200. 19 cents for each 1 over 18200.

Note that both the low income tax offset lito and lmito. Income thresholds Rate Tax payable on this income. Two further incentive regimes are proposed.

Taxable Income Tax Rate. C for every dollar over. This is expected to take effect from 1 July 2022.

Australia Residents Income Tax Tables in australia-income-tax-system. No tax on income between 1 - 18200. 37c for every dollar between - 180000.

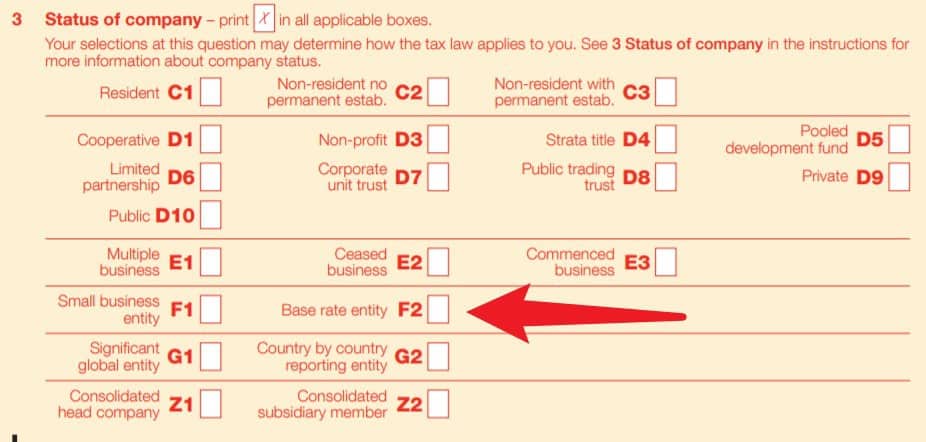

Base rate entity company tax rates The company tax rate for base rate entities has fallen from 275 to 26 in 20202021 financial year and is now down to 25 for 20212022 and later. Taxable income Tax on this income. Australia Income Tax Rates for 2022 Australia Income Tax Brackets Australia has a bracketed income tax system with five income tax brackets ranging from a low of 000 for those.

Tax Rates for 2022-2023. 19c for every dollar between 18201 - 0. Low and Middle Income Tax Offset LMITO income tax rates and thresholds for 2022.

Personal Income Tax Rate in Australia is expected to reach 4500 percent by the end of 2021 according to Trading Economics global macro models and analysts expectations. Taxable income tax on this income. 29467 plus 37 cents for each 1 over.

18201 to 45000 19c for each 1 over 18200. Make sure you click the apply filter or search button after entering your refinement.

Australia S Personal Tax Take Second Highest In Oecd

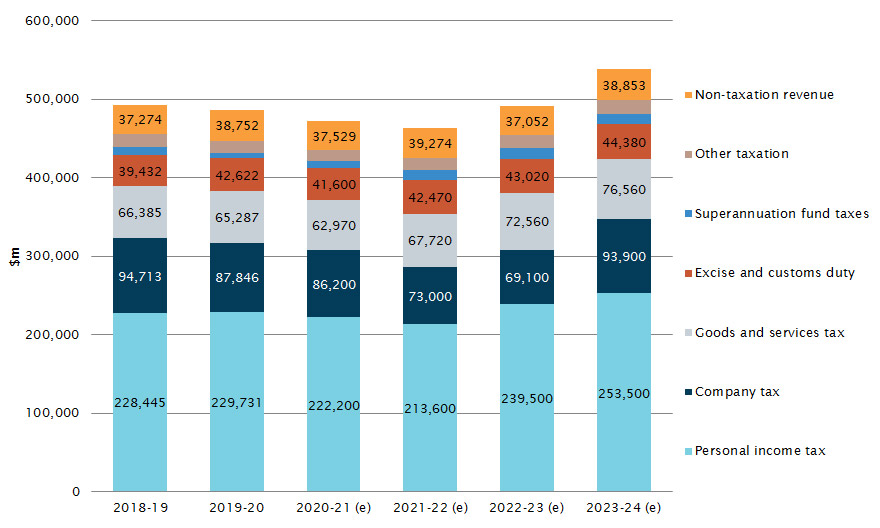

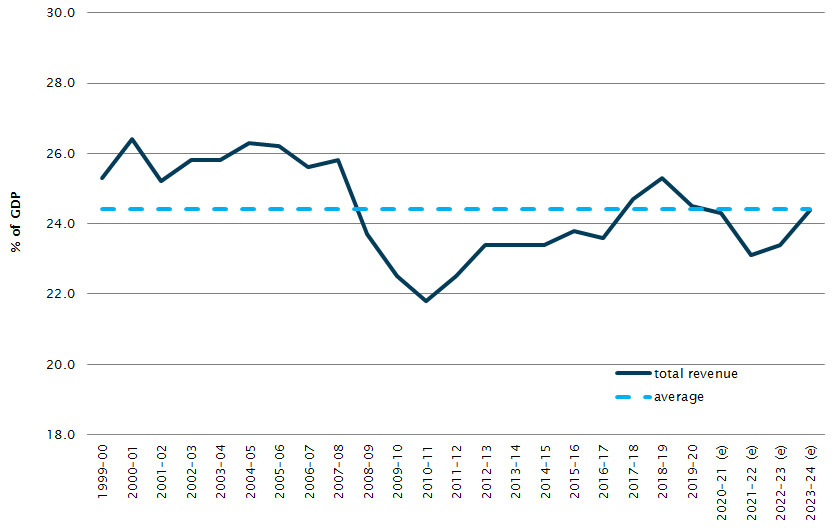

Australian Government Revenue Parliament Of Australia

Regional Advantage And Innovation Ebook By Rakuten Kobo In 2022 Natural Disaster Preparedness Innovation Achievement

Australian Government Revenue Parliament Of Australia

Top Personal Income Tax Rates In Europe 2022 Tax Foundation

Tax Brackets Australia See The Individual Income Tax Tables Here

Australian Income Tax Brackets And Rates For 2021 And 2022

H R Block Tax Return Australia Sydney Branding Poster Design Graphic Illustratio Design Rivista Design Per Rafforzare L Identita Design Brochure

Income Tax Cuts Calculator Australia Federal Budget 2020 21

Australia Macquaire Proof Of Address Bank Statement Template In Word And Pdf Format Doc And Pdf Datempl Tem In 2022 Statement Template Bank Statement Templates

Personal Income Tax Cuts 2018 2025 What It Means For You

2020 Income Tax Withholding Tables Changes Examples Income Tax Federal Income Tax Income

Capital Gains Tax Spreadsheet Australia Budget Spreadsheet Excel Spreadsheets Templates Spreadsheet Template

How Can Hr Help Independent Contractors Properly File Income Taxes In 2022 File Income Tax Profit And Loss Statement Filing Taxes

Online Tax Return Australia Lodge Tax Return Tax Refund Irs Taxes Tax Season

Australian Government Revenue Parliament Of Australia

-(1).gif?sfvrsn=e99fe96_0)

We Pay Our Taxes Woodside Energy