wake county nc sales tax calculator

Wake county nc sales tax calculator. To calculate the sales tax on your vehicle find the total sales tax fee for the city andor county.

Sales Taxes In The United States Wikiwand

Ad Avalara AvaTax can help you automate sales tax rate calculation and filing preparation.

. The calculator will show you the total sales tax amount as well as the county city and special district tax rates in the selected location. Maximum Possible Sales Tax. The calculator should not.

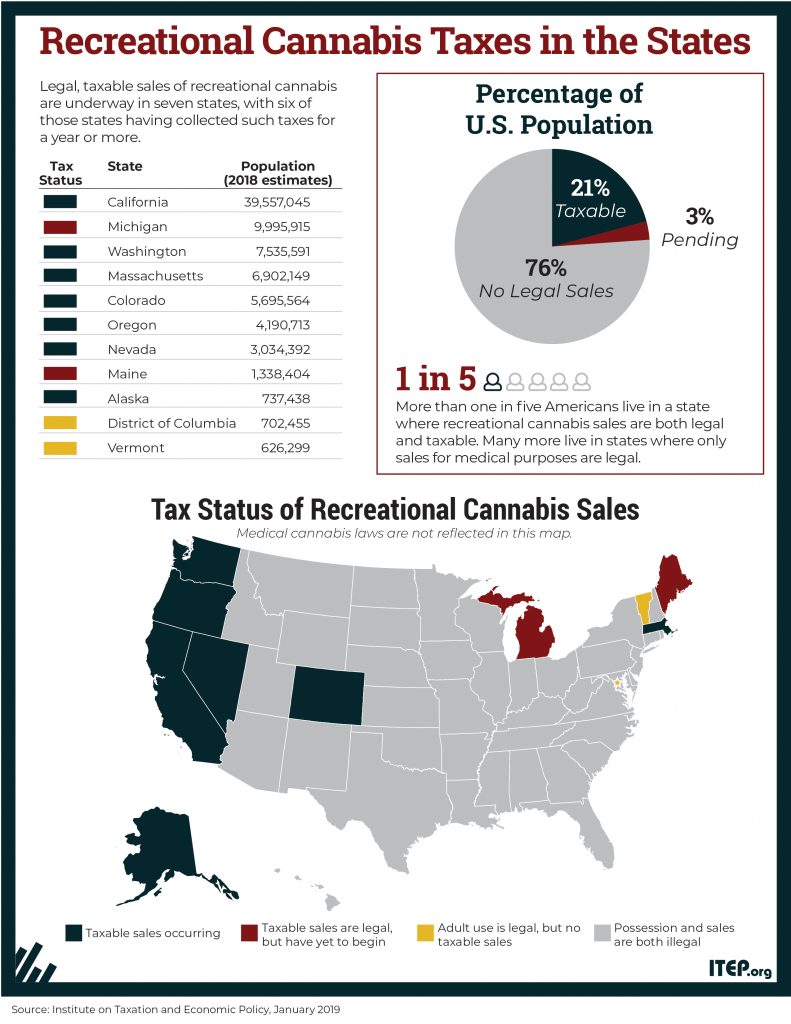

The Wake County North Carolina sales tax is 725 consisting of 475 North Carolina state sales tax and 250 Wake County local sales taxesThe local sales tax consists of a 200. The sales tax rate for Wake County was updated for the 2020 tax year this is the current sales tax rate we are using in the Wake. The total sales tax rate in any given location can be broken down into state county city and special district rates.

Please enter the following information to view an estimated property tax. Average Local State Sales Tax. Form Gen 562 County and Transit Sales and Use Tax Rates for Cities and Towns Excel Sorted by 5-Digit Zip Historical County Sales and Use Tax Rates.

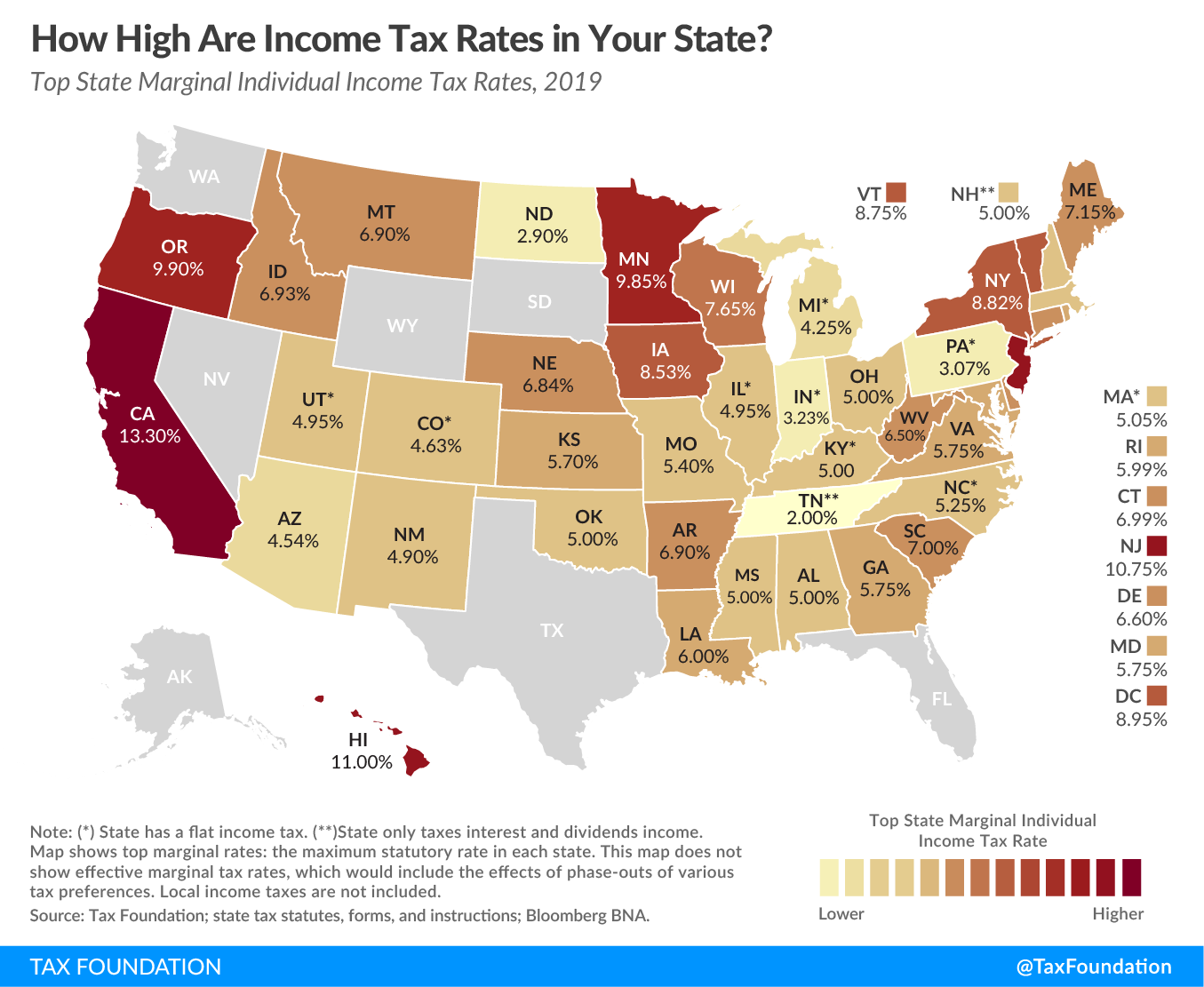

North Carolina State Sales Tax. How to Calculate North Carolina Sales Tax on a Car. Maximum Local Sales Tax.

The median property tax on a 22230000 house is 180063 in Wake County. This is the total of state county and city. The minimum combined 2022 sales tax rate for Wake Crossroads North Carolina is.

Local tax rates in North Carolina range from 0 to 275 making the sales tax range in North Carolina 475 to 75. The latest sales tax rate for Wake Forest NC. As a way to measure the quality.

The December 2020 total local sales tax rate was also 7250. The current total local sales tax rate in Wake County NC is 7250. The median property tax.

The calculator will show you the total sales tax amount as well as the county city and special district tax rates in the selected location. Verify Yes Sales Taxes Are Different For Different Foods Wfmynews2 Com Rocky Mount NC Sales Tax Rate. The minimum combined 2022 sales tax rate for Wake County North Carolina is.

First we used the number of households median home value and average property tax rate to calculate a per capita property tax collected for each county. Monroe NC Sales Tax Rate. Get the benefit of tax research and calculation experts with Avalara AvaTax software.

2000 x 10125 202500. Historical Total General State Local. What is the sales tax rate in Wake Crossroads North Carolina.

The median property tax on a 22230000 house is 173394 in North Carolina. This rate includes any state county city and local sales taxes. Average Sales Tax With Local.

The Wake County Department of Tax Administration appraises real estate and personal property within the county as well as generating and collecting the tax bills. This is the total of state and county sales tax rates. The property is not located in a municipality but is in a.

The average cumulative sales tax rate in the state of North Carolina is 694. In North Carolina it will always be at 3. Plus 20 Recycling fee 204500 estimated annual tax.

Wake County in North Carolina has a tax rate of 725 for 2022 this includes the North Carolina Sales Tax Rate of 475 and Local Sales Tax Rates in Wake County totaling 25. What is the sales tax rate in Wake County. This calculator is designed to estimate the county vehicle property tax for your vehicle.

North Carolina has a 475 sales tax and Wake County collects an. A motor vehicle with a value of 8500. Find your North Carolina combined state and local tax rate.

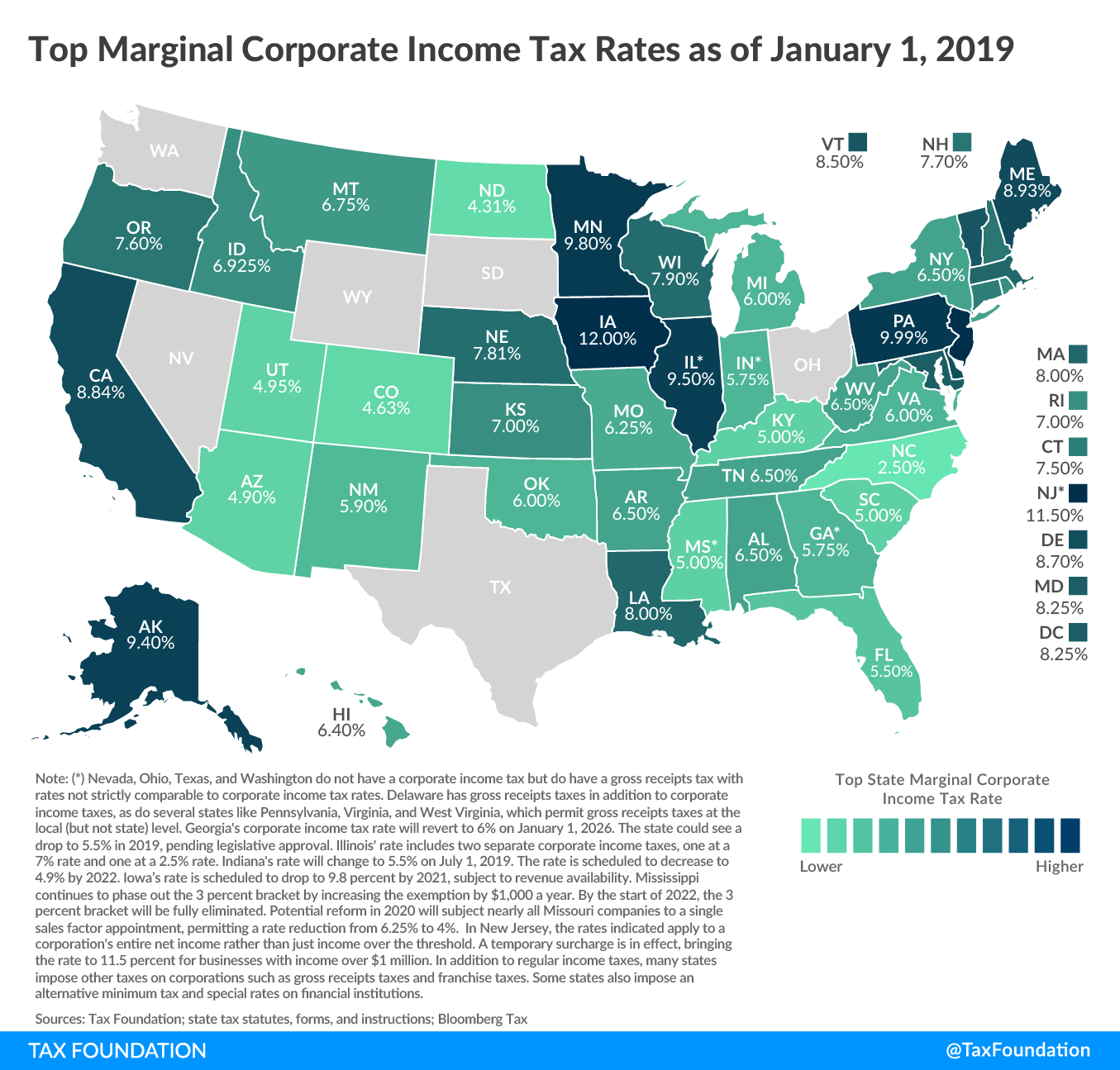

This takes into account the rates on the state level county level city level and special level. 2020 rates included for use while preparing your income tax. North Carolina has a 475 statewide sales tax rate.

Sales tax in Wake County North Carolina is currently 725. The average total salary of Retail Sales Associates in Wake County NC is 22500year based on 200 tax returns from TurboTax customers who reported their occupation as retail sales.

Taxes Cary Economic Development

North Carolina Sales Tax Guide For Businesses

Taxes Cary Economic Development

2022 Property Taxes By State Report Propertyshark

How To Calculate Sales Tax A Simple Guide Bench Accounting

Is Food Taxable In North Carolina Taxjar

Taxes Wake County Economic Development

Property Tax Calculator Casaplorer

North Carolina Sales Tax Calculator Reverse Sales Dremployee

North Carolina Nc Car Sales Tax Everything You Need To Know

Property Tax In North Carolina

Verify Yes Sales Taxes Are Different For Different Foods Wfmynews2 Com

Knightdale North Carolina Sales Tax Calculator 2022 Investomatica

North Carolina Sales Tax Guide And Calculator 2022 Taxjar

Sales Taxes In The United States Wikiwand

Wake County Nc Property Tax Calculator Smartasset

North Carolina Vehicle Sales Tax Fees Calculator Find The Best Car Price